Smart Metering and Smart Grid

$53.8bn

IoT utilities market by 2025

1.2bn

Smart meters by 2024

91.5%

Smart meter penetration in EU market by 2030

Smart utility solutions must achieve reliable connectivity over long periods, often in remote, harsh and hard-to-reach locations - our modules provide:

- Battery lives of several years in LPWA models

- MIMO antennas to greatly reduce errors and boost data speeds

- Over-the-air updates to avoid unnecessary field visits

- Wide temperature range to ensure durability in harsh environments

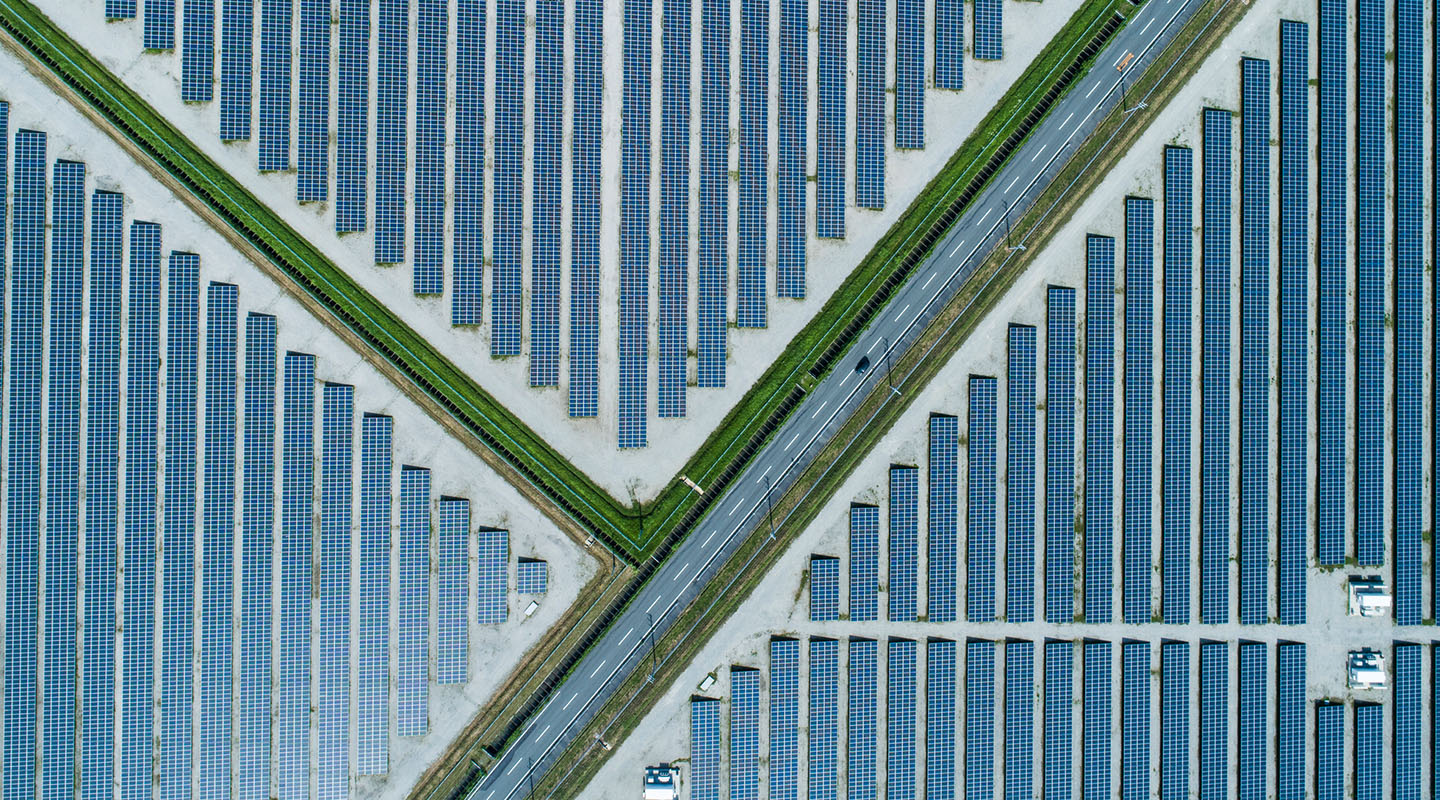

The utilities sector is a natural fit for connected technologies, and is already being fundamentally transformed with the IoT’s development. Connectivity allows utilities companies to move beyond centralised and inefficient practices, to adopt nimble, responsive and automated systems, closer to the point of need. In a sector where assets are frequently in remote or hard-to-reach locations, the value of reliable connectivity – with minimal demands on power and maintenance – is clear. Utilities already therefore account for the highest number of IoT endpoints, at 23.6% of the 5.81 billion units shipped in 2020 - with plenty of space for growth, as possibilities expand with the intersection of LPWA, Wi-Fi and 5G.

Smart meters, intelligent grids and cloud-based platforms allow customers to pay only for what they use; site visits to be largely eliminated; pricing to be more dynamic; and generation to become more efficient, based on accurate prediction of demand. IoT sensors can also improve workplace safety for those working in energy facilities, and assist the monitoring of water quality and leakage. At a time of rising urban populations coupled with ambitious sustainability targets, new energy sources coming into wider use, and the added complications wrought by COVID-19, the scope of IoT’s application in utilities is truly global.

The rapid growth already seen in this area, then, is set to accelerate over the next decade. Of the 24.1 billion connected devices forecast to be in use by 2030, fully 31% of enterprise deployments will be accounted for by utilities companies, representing 14% of all IoT connections worldwide. Some analysts expect the IoT utilities market to grow at a CAGR of 13.5% between 2019 and 2024, reaching a total worldwide of $53.8 billion.

Driving that growth will be worldwide adoption of smart meters, which will exceed 1.2 billion units by the end of 2024. Asia will be the largest market in that period, accounting for two thirds of the global total, with China the regional lead, followed by India and then Japan. In the USA and Canada, smart meter penetration is expected to rise 8% annually to pass 80% by 2024. In the EU, penetration is expected to reach 91.57% by 2030, representing a total aggregated investment of €40.7 billion.

Now is therefore the time to invest for those considering entry or expansion in this market. As customers and civic authorities grow increasingly insistent on energy efficiency in the face of climate change, there are now abundant opportunities for engineers and designers of smart utility solutions to help make good on the promise of smart cities and sustainable energy usage.

As a global supplier of IoT modules and antennas Quectel is ideally placed to support these initiatives with wireless connectivity which is reliable in harsh conditions and remote or deep locations, which can operate for years at a time without additional power, and which ensure secure, mission-critical data performance. We are proud of the role our modules play in this vital process, and look forward to working with all those who plan to do their part too.